So you've made the decision to go back to school and earn that degree. Great! But, with the rising costs of tuition and textbooks, one of the questions you'll be forced to answer for yourself is how will you pay for your education. Sure, you could pay for your entire degree program with student loans if you wanted to, but do you really want to be deeply in debt for the next several years?

So you've made the decision to go back to school and earn that degree. Great! But, with the rising costs of tuition and textbooks, one of the questions you'll be forced to answer for yourself is how will you pay for your education. Sure, you could pay for your entire degree program with student loans if you wanted to, but do you really want to be deeply in debt for the next several years?

Also, there can be unexpected expenses which come along with the cost of school: replacement computer equipment, lab fees, and day care for your kids. These are all things which can quickly empty your pocket book.

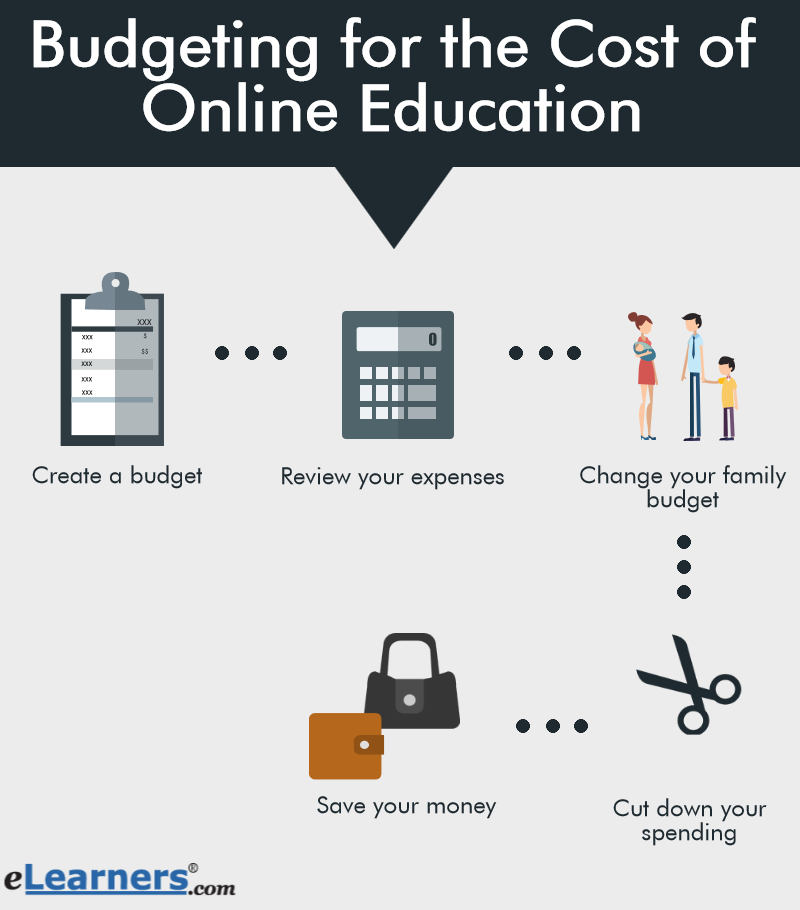

Creating a Budget

Before you can determine how much money you will need for your education, (either through loans, grants, scholarships or your own bank account), first determine two very important things:

- How much money you have available right now, and

- How much more money you could dedicate to education if you cut back in other areas.

Ideally, you are already living below your means and are able to put at least ten percent of your salary into things like your retirement account, savings or a 529 education savings plan. If you are living paycheck-to-paycheck and have no savings account at all, you've got some work to do.

Reviewing Your Income and Expenses

First, take stock of your current financial situation. If you don't have a budget or know what your current monthly expenses are, then start keeping track.

You could use a finance software tool or one of the many free online applications that are available. Keep track of all of your expenses for one month. Account for every single dollar you spend- even that latte you buy on your way to work every morning.

Next, you will want to determine your monthly income. Most people just assume it's the figure that they see on their pay stub each month, but don't forget to account for hidden expenses such as medical insurance, 401k or IRA deductions, extra taxes you have withdrawn and any other item which could be considered an expense. You may already have most of these items deducted from your salary pre-tax. If so, than this step has been taken care of for you.

Hopefully, your income exceeds your expenses by a healthy margin. If you still have at least 25 percent of your take-home salary available after you have paid all of your monthly expenses, including savings and investments, you are doing great. If you need every dime you earn just to make it to the next paycheck, you'll need to make some adjustments.

Changing Your Family Budget

There are two ways to help ensure you have a healthy monthly budget: reduce expenses and increase income. It's usually more effective to do both at the same time.

In order to make ends meet, you may want to consider working full time if you are currently working fewer than 40 hours a week. Or, you may want to take on extra part-time work if you are already working full time. If that's not a possibility, consider finding a higher-paying job, especially if it is related to your area of study. Remember, you have to allot time to your studies each day, so don't overwork yourself. That just leads to stress-related burnout.

To identify areas where you may be able to pare back your budget, you will need to determine which expenses are essential, and which are non-essential.

Essential expenses include:

- Housing

- Food

- Clothing

- Utilities

- Health Care

- Transportation

Non-essential expenses may include:

- Cable television

- Cell phones

- Store credit cards (keep one basic credit card for emergencies only)

- Dining out at restaurants (including fast food)

You may have heard the phrase "pay yourself first". This refers to the practice of taking a portion of each of your paychecks and depositing a certain percentage, usually ten percent, into a savings account before paying for any other expenses.

With payroll deduction, you can have this done automatically, and after awhile you may not even miss the money going directly into your savings account. Of course, you will want to make sure you have enough money to cover your essential expenses.

Cutting Down Your Spending

If you find that your take-home pay barely covers your essential expenses, you will need to make cuts to your non-essential expenses. Do you really need 200 channels on your television? Take note of your viewing habits. You may find that you watch only a small number of the channels available to you. If this is the case, consider scaling back your cable television service. Many cable providers offer something called "basic" or "expanded basic" cable service. While these services offer far fewer channels, you are also not paying for channels you don't watch, and you can save a substantial amount of money over the course of a year.

Cell phones have become such a part of everyday life they may seem like an essential expense. Some people have eliminated their regular "land line" phone service and use their cell phone as their home phone. If that's the case for you, shop around for the best plan. Basic cell phones work just fine. Save your money and pass on buying the latest fancy cell phone with multiple features. These phones and the service it takes to make use of the extra features always cost more.

While food is an essential expense, eating out at a restaurant every day is not. More often than not, you will save a substantial amount of money by preparing and eating the majority of your meals at home and brown-bagging your lunch at work. Set a budget for your food bill, and stick to it. Make a list of the grocery items you need to buy, and do not stray from this list when you go to the grocery store.

An effective way of creating your grocery list is to plan your daily menus in advance, and then purchase the items you will need to prepare the meals you have planned for the next week or two. By doing this, you will ensure you will buy only the items that you need.

Saving Your Money

The idea behind cutting non-essential expenses and concentrating on paying only essential expenses is to leave enough money left over to put into savings for your education.

The saved money could either be placed in a high-yield savings account, such as those offered by ING Direct or Emigrant Direct. You could also place the cash into a 529 education account offered by your state, or in another short-term investment fund such as a money-market account. The idea is to make sure this money is easily accessible and is only used for your education expenses.

Of course, you should have already established an emergency fund for yourself consisting of a month or two of living expenses.

Living a fiscally wise lifestyle and avoiding debt is always a good idea, but the expense of paying for an education is one which will pay for itself many times over in the future. Remember, and investment in your education is an investment in yourself!