Tax season is in full effect! This is where having an accounting degree can always come in handy to help you save money and take advantage of applicable tax benefits. But not everyone has earned an accounting degree! So if you’re not good at crunching numbers, don’t panic. We’re here to help fill you in on some tax credits for students that could potentially help improve your bottom line, if you qualify.

Let’s take a look at three of them.

Tax Credits for Students - American Opportunity Credit

The American Opportunity Credit, a modification of the Hope credit, was set up to help qualifying students and parents to pay for college expenses. In addition to opening up eligibility to a broader range of tax payers, the credit also adds required course materials to the list of qualifying expenses.

- Credit for college expenses can be claimed for four post-secondary education years

- Max annual credit is $2,500 for qualifying students

- Full credit is available to eligible students whose modified AGI is $80,000 or less ($160,000 if filing a joint return)

Visit irs.gov/uac/Tax-Benefits-for-Education:-Information-Center for more information.

Lifetime Learning Credit

The Lifetime Learning Credit is another tax credit option that helps eligible parents and students pay for post-secondary education. Because you can’t claim both the American Opportunity Credit and the Lifetime Learning Credit in the same year, you may benefit more from claiming the Lifetime Learning Credit if you’re a grad student, or you’re only taking one course.

- Students may claim up to $2,000 for qualified education expenses

- Expenses must be paid at eligible educational institutions

- There is no limit to the number of years a single student can claim the credit.

Qualified education expenses may include tuition and fees, room and board, books and supplies and other necessary expenses (such as transportation to and from school).

Visit irs.gov/uac/Tax-Benefits-for-Education:-Information-Center for more information.

Child and Dependent Care Credit

Though not directly related to education, the child and dependent care credit may be helpful if you paid work-related expenses for the care of a qualifying individual. This means that you paid for the necessary care of the individual to enable you to work or find a job. As such, this credit may be particularly relevant to eligible you’re a non-traditional students and parents.

- To qualify, your dependent child must be under age 13

- If your dependent is your spouse who is physically or mentally incapable of self-care, they must have lived with you for more than 6 months

- Total expenses used toward the credit are capped at $3,000 (for one qualifying individual) or $6,000 (for two or more qualifying individuals)

Source: irs.gov/taxtopics/tc602.html

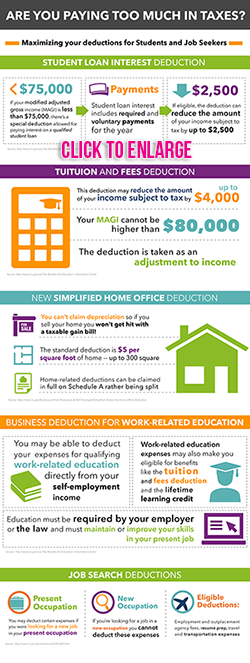

Check out our infographic to learn more about four tax deductions for students and job hunters!