Sponsored Online Programs Available

Finance Degree Online

Online finance degree programs teach how to overcome the key challenges facing the financial health of companies in the modern business world. These include capital financing, risk assessment, and firm valuation.

This also includes ethics and how to navigate ever-expanding regulations. Therefore, while earning a finance degree online, courses look at how each of these principles of finance fit into overall business strategies.

Fun Fact

The United States has about 4% of the world’s population and generates more than 20% of the world’s GDP.

Online Finance Degree: Basics

Finance is a broad term that covers both how money is managed and the actual process of acquiring needed funds. Typically, the field is broken into three sub categories, which are listed below.

- Personal Finance

- Corporate Finance

- Public Finance

When it comes to corporate finance, normally businesses need funds for three reasons. These reasons are listed here.

- Business activities

- Making purchases

- Investing

What You’ll Learn

Online finance degree programs cover the theories and concepts of the driving forces of business. Typically, this is through analyzing case studies and quantitative and qualitative data.

Some online finance courses look at how to help businesses and individuals make investment decisions by studying topics listed here.

- Evaluate current and historical data

- Study economic and business trends

- Examine a company’s financial statements

- Recommend investments or collections of investments[i]

Keep in mind that each school is different and may have a unique make-up. Check with a few of your options to find one that matches your goals.

Common Finance Classes Online

While pursuing your online finance degree, courses build upon previous education and professional experience to develop a through understanding of all things finance. Through research, writing, and analysis, courses teach the analytical and conceptual skills necessary in the field of finance.

Check out the list below for some of the common online finance classes in a degree in finance.

- Financial Statements and Managerial Decisions

- Business Forecasting Techniques

- Corporation Finance

- Investments and Portfolio Management

- Financial Markets and Institutions

- Short-Term Financial Management

- Capital Budgeting and Financing

- Derivatives for Financial Modeling

- Essentials of Economic Theory

- Valuation of Assets, Entities, and Opportunities

Keep in mind that specific courses may vary from school to school.

FINANCE DEGREE INSIGHT

We asked Online Finance Degrees holders, Is an economics degree more difficult to earn than a finance degree?

"Both majors are probably equally difficult, although folks who are adept at math would do better with a Finance and those who lean more towards logic would be better in Economics."

Click To Tweet!.png)

- Andrew Schrage, CEO at Money Crashers

Different Online Finance Degrees Levels

Typically, there are five different levels of online finance degrees. Each of these levels present the principles of finance, and build upon previous knowledge in the field. As a result, normally the higher the degree level, the more difficult coursework and graduation requirements are.

For instance, a doctorate level Investments and Portfolio Management course asks students to perform more research, writing, and critical analysis than an associates level course with the same name.

Consider your own goals and current education level to find a perfect program for you among finance degrees,

Associate Degree in Finance Online

Pursuing an online associates degree in finance teaches the fundamentals of finance to provide you a chance to further your education. This includes how to manage a company’s financial records, as well as how to invest in income-producing ventures.

Typically, associates degree programs require that you have earned a high school or equivalent diploma. Some schools may have other, harder admissions requirements.

Most full-time students can earn their associates degree in two years. Courses normally include a few general education courses and core business classes.

Online Bachelor Finance Degrees

Online bachelor finance degree programs teach the principles of finance. Typically, these include those listed here.

- Capital Management

- Investment and Portfolio Management

- Financial Institutions

- Personal Finance

In addition to your major courses in finance, most programs ask that you take a few general education and core business classes. This may help to provide you with a well-rounded education.

Bachelors degree programs ask that you have earned a high school or equivalent diploma. Some schools may ask that you achieved a minimum score on the SATs or earned a minimum GPA. Most full-time students can earn their bachelors degree in four years.

Keep in mind that each school has a unique make-up. Therefore, specific requirements and timelines may depend on when courses are available.

Online Finance Certificate

Certificates are shorter, non-degree programs designed for part-time students who work full-time. Many online finance certificates ask that if you do not have a few years of work experience in finance, that you be proficient and have an educational background in the field.

Most certificates focus on building your overall business acumen and developing a deeper understanding of the concepts, theories, and the application of those principles in the field of finance.

Normally, to earn your certificate, programs ask that you complete four to eight courses. Most students can earn their certificate in one to two years.

Online Masters Degree in Finance

While earning an online masters degree in finance, programs teach a complete understanding of the principles of finance and general business by developing financial-analysis and strategic perspective skills.

Some programs offer concentrations, which tailor your course of study to a specific area of finance.

Most programs ask that you have earned a bachelors degree from an accredited university. Each school has their own admissions requirements, which may involve those listed here.

- Minimum GPA

- Submit a resume

- Minimum GRE score

Normally, it takes students two to four years to earn their masters degree. Upon completing all required courses, many schools ask that you complete a capstone or thesis project.

PhD in Finance Online

Online finance PhD programs develop and use financial models and theories to gain a complete understanding of some of the most difficult financial problems. This helps you perform your own research to contribute to the field through analyzing case studies and expanding your expertise in financial theories and practices.

Many schools ask that you have earned a masters degree from an accredited university with a 3.0 GPA or higher. However, each school may have their own requirements.

Upon completing all required courses, most schools ask that you write, present, and defend a dissertation. Some programs also ask that you pass a comprehensive exam.

Typically, it takes students three to five years to earn their PhD.

What Can You Do with an Online Finance Degree?

Upon earning your online finance degree, you may pursue a number of different careers after you earn your degree in finance. Many of these positions require a bachelors degree, though some companies look for candidates with a masters degree, especially for promotions.[ii]

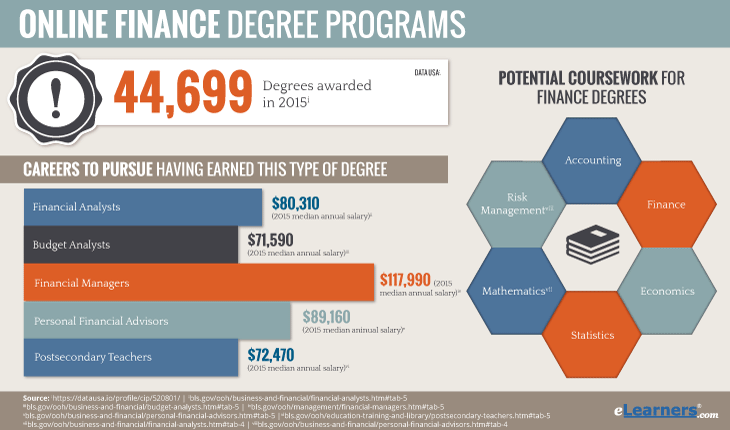

Some of these jobs, and their 2015 median annual salary, include those listed here.

- Financial Analyst: $80,310[iii]

- Budget Analyst: $71,590[iv]

- Financial Manager: $117,990[v]

- Personal Financial Advisor: $89,160[vi]

Some students who earn their PhD in finance choose to pursue a career as a postsecondary teacher. According the Bureau of Labor Statistics (BLS), the median annual salary in 2015 for postsecondary teachers was $72,470.[vii] The BLS expects the number of postsecondary teachers to increase 13% for the ten years from 2014 to 2024.[viii]

Take the Next Step towards a Degree in Finance!

Take the next step to earning your online finance degree. Click on any of the sponsored listings on this page. There, you can find program descriptions and the specific requirements for each school. You can even contact your favorite schools directly to request more information.

[i] bls.gov/ooh/business-and-financial/financial-analysts.htm#tab-2 [ii] bls.gov/ooh/business-and-financial/financial-analysts.htm#tab-4 [iii] bls.gov/ooh/business-and-financial/financial-analysts.htm#tab-5 [iv] bls.gov/ooh/business-and-financial/budget-analysts.htm#tab-5 [v] bls.gov/ooh/management/financial-managers.htm#tab-5 [vi] bls.gov/ooh/business-and-financial/personal-financial-advisors.htm#tab-5 [vii] bls.gov/ooh/education-training-and-library/postsecondary-teachers.htm#tab-5 [viii] bls.gov/ooh/education-training-and-library/postsecondary-teachers.htm#tab-6