Sponsored Online Programs Available

Bachelors Degree in Finance

Online Bachelors Degree in Finance programs teach the fundamental principles of finance. This may include developing problem-solving skills to study business and financial conditions. Typically, courses use case studies, as well as quantitative and qualitative research methods, to teach how to create financial plans.

Fun Fact

Typically, a $1 bill has a life expectancy of about 5.9 years. On the other hand, a $100 bill has a life expectancy of up to 15 years.

Online Bachelors Degree in Finance: Basics

Many online finance bachelor degree programs look at developing analytical and conceptual skills. Typically, this is through studying the principles of finance, including some listed here.

- Capital Management

- Investments and Portfolio Management

- Financial Institutions

- Personal Finance

Often, schools teach how to apply financial theories in each of these areas to study how to perform financial analysis. While these are the main focus of many courses, there are other topics in finance that may be studied, such as economics and the construction of financial documents.

How Long Does It Take to Earn an Online Bachelors in Finance?

Typically, it takes full-time students four years to earn their bachelors degree. However, the length of each school program may vary and depend on when courses are available. It may also take longer for part-time students. Check with a few schools to find one that matches your goals.

Admissions Requirements for Online Finance Bachelor Degree Programs

The specific admissions requirements for online finance bachelor degree programs vary from school to school. However, most schools ask that you have earned a high school or equivalent diploma.

Some schools may also ask that you meet additional requirements, such as those listed here.

- Minimum high school or equivalent GPA

- Minimum SAT score

- Submit all transcripts

Keep in mind that all online finance bachelor degree programs have their own admissions requirements. Therefore, you should check with a few options to find one that matches your goals.

What Is Finance?

Finance describes two related activities. The first is the study of how money is managed. The other is the process of acquiring needed funds. Finance is normally separated into the three subcategories listed below.

- Capital Finance

- Personal Finance

- Public Finance

Each of these relate to individuals, businesses, and the government and their respective financial decisions. Some of these decisions can include pursuing sound investments, obtaining low-cost credit, banking, and other parts.

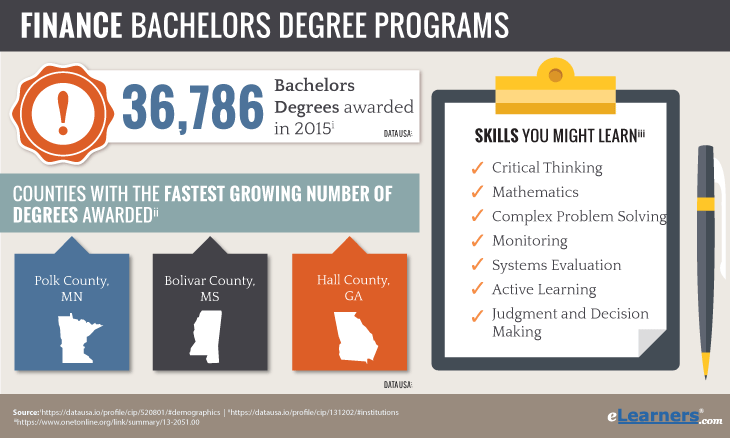

What You’ll Learn While Earning an Online Bachelors Degree in Finance

Online finance bachelor degree programs teach a foundation in the principles of finance. Many courses cover investment options, such as commodities and bonds. Courses also look at risk assessment, capital budgeting, and other topics listed here.

- Accounting cycle and construction of financial statements

- Fundamentals of business finance

- Function of finance in the modern corporation

- Financial evaluation and management of business

- Legal and ethical issues of concern to businesses

These are just some of the topics you may learn while pursuing a bachelor of finance online. Each school has a unique make-up and a specific course of study may vary from school to school. Therefore, look at a few schools to find a perfect match for you.

What Classes Do Online Bachelors Degree in Finance Majors Take?

Many online finance bachelor degree programs combine finance courses with a number of general business courses, such as marketing and management. This may help you understand how finance fits into the overall business strategy.

Many online bachelors degree in finance programs also ask that you complete a number of general education courses to satisfy liberal arts requirements. This may provide you with a well-rounded education.

Some common course offers in finance are listed below.

- Corporate Finance

- Financial Markets

- Financial Regulations and Ethics

- Investments and Portfolio Management

- International Trade and Finance

- Strategic Management and Business Policy

- Risk Management and Insurance

- Personal Financial Management

- Financial and Managerial Accounting for Decision Making

- Financial Statement Analysis

Remember that each school has a unique make-up. Therefore, specific courses and the names of classes may vary from school to school. You should research a few options to find a school that matches your goals.

What’s the Difference Between Finance and Accounting?

Finance is the study of the management of money. On the other hand, accounting involves obtaining, collecting, organizing, and otherwise handling financial information. Therefore, the main difference is that finance is actually moving money around and accounting is keeping track of that movement.

As a result, both finance and accounting programs have many overlapping courses and try to develop a number of similar skills. However, finance has more influence on the long-term planning and strategy.

Accounting has more influence making sure that a company’s records are accurate and meet all regulations and reporting rules. Keep in mind that some schools may even combine the two degrees into one program. Check with a few schools to find one that matches your goals.

What Is Strategic Financial Management?

Strategic financial management is the planning and management of a business’s financial resources. This may help the company achieves its goals to provide maximum value to shareholders.

Typically, strategic financial management includes the topics listed here.

- Defining a company’s business objectives

- Identifying and quantifying its resources

- Devising a plan

- Establishing procedures for collecting an analyzing data

Therefore, some online bachelors degree in finance courses focus on how to create strategic financial plans for businesses. Other courses may look at how to update plans to help businesses achieve their goals.

Common Careers in Finance

Online finance bachelor degree programs may prepare you for a number of different careers. These careers typically look at current and historical financial data and prepare written reports. This can include economic and business trends and analyzing a company’s financial statements.[i]

Some of the jobs in finance include those listed here.

- Budget Analysts: $71,590[ii]

- Financial Analysts: $80,310[iii]

- Securities, Commodities, and Financial Services Sales Agents: $71,550[iv]

- Financial Managers: $117,990[v]

- Personal Financial Advisors: $89,160[vi]

These positions typically ask that candidates have a bachelors degree. However, some positions and some companies look for candidates with a masters degree.[vii] Often, a masters degree may help candidates get promoted and advance in their careers.

Additional Certifications for Careers in Finance

Some finance jobs ask that you earn additional certifications for specific roles. To earn these certifications, some ask that you have sponsorship from an employer. Therefore, it may not be expected that you have these certifications before you are hired.[viii]

Some of the available certifications are listed here.

- Financial Industry Regulatory Authority (FINRA)

- Certified Government Financial Manager, from the Association of Government Accountants

- Chartered Financial Analyst

Keep in mind that there may be other certifications depending on your position. Each may have different requirements, such as passing exams or continuing education.[ix] You should check with the ones that match your goals for specific rules.

Take the Next Step!

Are you looking to earn a degree that may enhance your mathematical and analytical skills? Then take the next step to find the perfect school for you.

Click on any of the sponsored listings on this page. Then, you can read all about the online bachelors degree in finance programs and the specific structure of each school. You can even contact your favorites directly to request more information and apply today to earn your bachelor of finance online.

[i] bls.gov/ooh/business-and-financial/financial-analysts.htm#tab-2 [ii] bls.gov/ooh/business-and-financial/budget-analysts.htm#tab-5 [iii] bls.gov/ooh/business-and-financial/financial-analysts.htm#tab-5 [iv] bls.gov/ooh/sales/securities-commodities-and-financial-services-sales-agents.htm#tab-5 [v] bls.gov/ooh/management/financial-managers.htm#tab-5 [vi] bls.gov/ooh/business-and-financial/personal-financial-advisors.htm#tab-5 [vii] https://www.bls.gov/ooh/business-and-financial/budget-analysts.htm#tab-4 [viii] bls.gov/ooh/business-and-financial/financial-analysts.htm#tab-4 [ix] bls.gov/ooh/business-and-financial/budget-analysts.htm#tab-4