Sponsored Online Programs Available

Online Accounting Degree & Certificate Programs

Online accounting degree programs offer a flexible alternative for career-focused accounting education. With degrees ranging from associates through doctorate, potentially including variety of unique accounting specializations, current and aspiring accountants may find the education they need, from the schools they want, in a convenient, work and life friendly format.

Some programs, particularly associate or bachelors in accounting programs, may be designed primarily to serve those new to the accounting profession, with little or no experience, whereas higher degree levels may aim to serve experienced professionals. Whether you’re interested in finding a way to top your accounting skills, or working toward an advanced certification, online accounting degree programs may be one of your best options.

Read more here and check out our 3 easy steps toward earning an online accounting degree, below!

Online Accounting Degree Basics

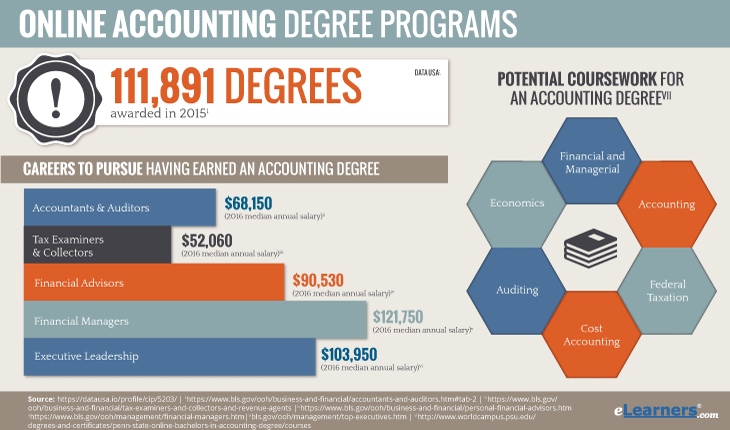

As a profession, accounting focuses on understanding the current financials of an organization. Online accounting degree programs also focus on these topics. These programs are generally fairly career-oriented, designed to hone a set of skills and knowledge directly relevant to what one might be responsible for in a professional context.i

What does that mean for you as you earn an online accounting degree? It means your program is likely to be both business-oriented and analytical, emphasizing technical skills, mathematics, and an understanding of business practices, ethics, and law. The specific blend of topics covered, however, may vary depending on the type of program you enroll in, the level of the degree, whether it focuses on a certain concentration area, and other factors.

In some cases, programs might take this career-focus a step further, and ask students to gain practical experience working in a real-world setting as an intern. That’s something to take into consideration as an online student; if you chose this format because you need the flexibility or already work full time, offline requirements like internships may entail additional planning or other arrangements.

Additional Requirements

In order to become an accountant, people generally need to earn at least a bachelor’s degree. However, there may be additional requirements depending on the type of accounting you’re interested in doing, or how competitive you want to be on the job market. For example, if your accounting role requires you to file reports with the SEC, you’d need to become a CPA. Many accountants choose to become CPAs regardless, in order to gain a competitive edge on the job market or with clientele.

How to become a CPA may vary by state. In addition to passing a national exam, CPA candidates usually need to complete a minimum amount of coursework beyond the bachelors level. As such, some people may choose to earn a master’s degree to earn those credits. Depending what state you live and work in, you may also need to complete continuing education requirements to maintain your CPA status.

In addition to licensure as a CPA, some may opt to pursue more specialized professional certification to support a more specific role as an internal auditor, fraud examiner, or management accountant. For more information on different certifications and their requirements, reach out to your selected online accounting program.

Online Accounting Degree General Programs

If you’re looking for an online accounting degree that develops your more generalized accounting skills, a variety of programs may suit your interests. Many programs, rather than focusing on one type of accounting, aim to build the general know-how to succeed in a variety of accounting-related roles. These more generalized programs may be offered from associates through doctorate.

Online Associates Degree in Accounting

At the associate level, online accounting degree programs most often aim to prepare students for entry-level roles as accounting, bookkeeping, or payroll clerks, or similar roles. As such, in addition to developing general financial literacy, the curriculum may emphasize basic career-oriented technical skills like mathematics, statistics, computers, bookkeeping software, spreadsheets, etc.ii

Some associate in accounting programs may be related to bachelor in accounting programs, enabling students to apply some of their work toward the completion of a bachelors degree at a later date.

Online Bachelors in Accounting

Online bachelors in accounting programs are generally somewhat more advanced or in-depth than accounting programs, preparing students for roles like entry-level accountant or auditor. Because a bachelors degree is generally not sufficient to satisfy the education requirements for a CPA exam, some schools offer a continuous bachelors to masters program, enabling students to work toward both degrees in a single shot.

In addition to developing basic accounting skills, bachelors programs may touch on more advanced topics such as tax accounting skills and basic tax law, auditing procedures, financial regulations, and more.

Online Accounting Masters Programs

Online masters in accounting programs may allow students to earn one of several degree types. These include the following.

- Master of Accounting (MAcc)

- Master of Science in Accounting (MSA)

- Master of Business Administration in Accounting (MBA)

The difference between each of these programs may vary considerably. Generally, MBA programs focus primarily on business, organizational, and leadership skills, with an emphasis on accounting skills or leadership in accounting organizations.

Meanwhile, the MAcc and MSA focus more on developing technical skills related to accounting. Those two degree options may vary on an individual basis. Differences could come down to naming conventions at that school, accrediting organization, and other factors. For more information about what makes each degree option unique, follow up with your preferred online masters in accounting programs.

Doctorate in Accounting Online

Online PhD in Accounting Programs are generally designed for experienced accounting professionals who want to move in a new direction—whether that’s leadership within one’s organization, teaching about accounting in a university setting, or taking on a consultant role. As with PhD programs in other fields, the specifics of your curriculum could vary considerably depending on your individual path of study.

However, broadly, accounting PhD programs tend to combine business and professional skills with scholarly expertise, research, and thought leadership. These programs may not only help you to hone the expertise and leadership skills to stand out, but also help you develop the research chops to contribute to the larger body of knowledge that drives the accounting industry into the future.

Some students preferring a business angle may instead choose to earn a DBA in Accounting. These programs would be designed with MBAs in mind, building on that expertise and, like MBA programs, focusing more on general business skills and leadership than the technical aspects of accounting.

Online Accounting Certificate Programs

Online accounting certificate programs could appeal to students with a variety of goals. Here are 4 examples why you might consider earning one.

- To earn enough credits to sit for your CPA exam, if you aren’t ready for a masters program.

- To learn more about a specific accounting skill area or specialty.

- As continuing education to maintain your CPA.

- To try out graduate accounting education before you commit to a full program.

And more!

Online accounting certificates may come in all shapes and sizes. They’re usually shorter than degree programs, and may be designed to support any number of objectives. Some certificate program courses may even be transferrable toward a degree program later—so if you earn a graduate certificate and later decide you want your masters, you might be able to apply some of that work toward the completion of that degree program.

For more information about the goals, curriculum, and outcomes of a certain accounting certificate program, reach out to the school in question.

Online Internal Auditing Programs

A subset of online accounting degree programs, internal auditing programs combine accounting with analytical skills to support roles as internal auditors. Internal auditors are part of a system of checks and balances within an organization. They perform regular checks to make sure that business operations comply with federal and state regulations, particularly the Sarbanes-Oxley Act.

They also might ensure accurate and comprehensive record keeping, and identify potential sources of risk. Internal auditors may examine anything from operations and processes to data infrastructure, using a variety of techniques for analysis and reporting.

These types of online programs generally build on prior accounting expertise, and tend to be offered at the masters level or higher.

Online Masters in Internal Auditing

Online auditing degrees—or, more specifically, online masters in accounting with auditing concentrations—aim to develop fluency with the Sarbanes-Oxley Act, how those regulations impact businesses, and how organizations must behave in order to comply with those regulations.

Other topics of study include information assurance, business law and ethics, taxation, financial reporting, statistical analysis, and fraud prevention.

Some masters programs may also aim to help students work toward a professional certification as an internal auditor.

Online Internal Auditing Certificate Programs

As with masters programs, online internal auditing certificate programs may in some cases be designed to help students prepare for credential or certification exams. However, that’s not always the case. Typically offered at the graduate level (as a masters or post-masters certificate), auditing certificate programs may also function in an add-on capacity, that is developing additional expertise beyond one’s existing body of knowledge, or as continuing education to maintain an existing credential.

Some programs may even focus on one specific analysis methodology, challenge, or type of fraud.

Online Taxation Degree Programs

Tax accounting is a unique specialization within the larger category of online accounting degree programs. These programs are typically focused on tax law and how those laws impact a set of finances.

Accountants interested in working in taxation could approach that in a few different ways, including through on-the-job training and experience. Many current or aspiring tax accountants opt to pursue graduate education to enhance their fluency with tax law and related accounting strategies.

The Two Types

Broadly speaking, both in a professional sense and to a lesser degree academically, taxation could be divided up into two categories.

(1) The first of these is individual taxation.

Tax accountants who work with individuals would primarily look at that person or family’s assets, capital gains and losses, tax exemptions and deductions. In most cases, this would entail helping people to prepare their annual tax returns.

With some exceptions, individual tax accounting tends to be smaller scale in terms of the finances one would be working with. While some tax accounting graduate programs might look at individual tax preparation, this is less common than the alternative.

(2) Then there’s corporate tax accounting.

This is a broader category, encompassing the majority of online tax accounting programs.

Corporate tax accountants work with an organization’s assets to ensure compliance with tax law, and stay abreast of tax burdens falling on that organization. Corporate tax accounting is comparatively complex. Accountants may work with incoming finances as well as those going to shareholders.

Because there’s so much data involved, many tax accountants instead choose to specialize in one particular type of taxation or tax law. These would generally be covered in most taxation-oriented programs, and in some cases may even be available as concentrations.

- International Taxation: This focus area generally impacts businesses doing business around the world, who are impacted by tax laws of other countries. International tax accountants would ensure that all relevant tax laws are accounted for, as well as how each of those sets of laws interact or conflict.

- Federal Tax: This type of tax accounting would deal specifically with taxation and tax laws issued by the US federal government (or the federal government in the country in question).

- State and Local Tax (SALT): SALT has to do with tax laws specific to that region, at the state level or within a specific city or town. As such, specifics might vary widely depending on the state or locale in question.

- Income Tax: At the corporate level, income tax accounting has to do with payroll, ensuring that any necessary payroll taxes are dealt with on the business end, and other related deductions and issues are accounted for.

Online Masters in Tax

Earning a masters in tax accounting online could include several degree types. In addition to the types described above (particularly MSA and M.Acc. programs), one might choose to pursue a few unique options. That includes:

- Master of Science in Taxation (MST)

While in some cases these programs could be quite similar to MAcc programs with a concentration in tax law, often, there would be a few key differences. In particular, MST programs might place a heavier emphasis on tax law and regulations than a Master of Accountancy would, in addition to the advanced mathematical, technical, and accounting skills one would find at the masters level. - Tax Law LL.M.

LLM stands for Latin Legum Magister and is a masters degree issued by a law school. Like it sounds, earning an LLM in Tax means focusing specifically on tax law. These programs may not place as much of an emphasis on accounting skills and methods than MST programs might. However, if you’re interested in practicing tax law as an attorney, an LLM might be an attractive first step.

Online Taxation Doctorate Programs

Pursuing a doctorate in taxation online, one might work toward several different types of degrees. Each of these degrees might emphasize a different aspect of tax accounting, and support different career paths. Some example degrees one might pursue include the following.

- PhD in Tax Accountancy: These programs could be fairly diverse in nature. Some might focus on tax accounting in the field, helping students prepare for leadership or consulting roles. Others might look more at thought leadership and taxation research, or prepare students to lecture about tax accounting in a business school or university setting.

- JD in Taxation: Juris Doctor is a law degree generally aimed toward those who want to practice law as an attorney or in judicial roles. Taxation JD programs may develop fluency in tax law, as LLM programs might. Students might prepare to advise or represent corporations in a variety of taxation-related situations including federal audits.

- SJD in Taxation: As with JD programs, SJDs are also typically offered by law schools. Also similar to JD, they might focus specifically on tax law with comparably less focus on accounting skills. SJDs are generally considered terminal degrees, and are a research-focused alternative, PhD equivalent to the JD.

Online Certificate in Tax Accounting

Because most taxation programs are offered at the graduate level, the majority of taxation certificates tend to be masters or post-masters certificates. While some programs may be generalized, helping accountants gain a command of the essentials of tax accounting, others might be more specialized.

Specialization

For example, they could look at one particular branch of taxation (like SALT), or a certain tax accounting methodology. Some online taxation graduate certificates might appeal to professional accountants or CPAs interested in moving into tax accounting from another area. Others might support experienced tax professionals who want to maintain a certification, start working in a different area of tax accounting or tax law, or enhance their skills.

Online Forensic Accounting Degree Programs

Forensic accounting is a unique specialization that could be found within some online accounting degree programs. Programs typically discuss how you can apply accounting and auditing skills to investigate an entity’s financial activity.

In the field, forensic accountants may be involved in investigating fraud and preparing evidence to be presented in court cases. Unlike internal auditing, however, forensic accountants aren’t interested in identifying risk and mitigating it.

Rather, forensic accountants aim to establish beyond doubt the reality of a company’s finances and activities, legal or otherwise.

Who Employs Forensic Accountants?

Forensic accountants might find employment in a variety of context ranging from:

- Police and other law enforcement agencies

- Law firms

- Insurance agencies

- Corporations

Because it’s such a unique work area, some accountants may choose to pursue a specialized degree to tailor their skills in support of this career path.

Online forensic accounting degrees might be offered at the bachelors and masters levels.

Online Bachelors in Forensic Accounting

Online bachelors in forensic accounting programs may aim to establish a firm foundation of skills and knowledge, such as:

- General accounting skills

- Legal knowledge

- Analytical skills

As such, these programs may cover, in addition to general accounting and mathematics, such topics as:

- Investigative techniques

- Auditing

- Business valuation

- Federal taxation

Additionally, programs might hone one’s fluency in writing and understanding financial statements, and identifying fraudulent financial statements. In some cases, forensic accounting may also be referred to as forensic auditing. Most often, online bachelors in forensic accounting may issue a bachelor of science degree upon completion. However, some additional degree types may also be available.

Online Forensic Accounting Masters Programs

Online masters in forensic accounting programs hone advanced investigative analysis skills to identify fraud and assist in the prosecution of financial crimes. At the masters level, programs may encourage a more in-depth literacy with financial systems and different types of crime.

For example, courses cover topics like:

- Mergers and acquisitions

- Bankruptcy law

- Contract law

Additionally, programs may discuss accounting quality control, auditing methodologies, different types of fraud, and complex legal and ethical issues. Additionally, at the masters level, some programs may aim to support students in becoming credentialed as forensic accountants.

Online Forensic Accounting Certificate Programs

Most online forensic accounting certificate programs are offered at the graduate level, though some bachelors level certificates may also be available.

Topics potentially covered include specific types of financial fraud such as embezzlement, or certain investigative techniques or technologies.

However, some certificate programs, rather than focusing narrowly on a specific topic of interest within forensic accounting, may rather be designed to help students:

- Prepare to sit for certification exams

- Covering material they might need to know to pass the exams

- Earning the necessary post-bachelor credits

Search for Accounting Degree Online Programs Today

There's just 3 easy steps toward an online accounting degree today with eLearners!

- First, narrow down your search results using the menu. Just select your preferred degree level!

- Next, read more about what to expect in those programs, and review the sponsored listings.

- Finally, once you identify some programs that meet your criteria, click on the Request Info button to get in touch and start your application!

[i] bls.gov/ooh/business-and-financial/accountants-and-auditors.htm#tab-2 | [ii] bls.gov/ooh/office-and-administrative-support/bookkeeping-accounting-and-auditing-clerks.htm